Ubud Luxury Villa Rental Market Statistics — 2025

Based on AIRDNA analytics for 3-bedroom luxury villas in Ubud

Book design is the art of incorporating the content, style, format, design, and sequence of the various components of a book into a coherent whole. In the words of Jan Tschichold, "Methods and rules that cannot be improved upon have been developed over centuries. To produce perfect books, these rules must be revived and applied." The front matter, or preliminaries, is the first section of a book and typically has the fewest pages.

Overview

Ubud continues to strengthen its position as one of Bali’s most attractive destinations for luxury short-term rentals. Despite a softer tourism cycle in 2025, demand for high-quality villas remains stable, supported by long-stay tourism, wellness retreats, and the growing influx of remote professionals.

The following analysis is based on AIRDNA data for 3-bedroom luxury villas in Ubud and reflects performance trends over the last 12 months.

Key Performance Indicators (KPI)

Annual Revenue

Luxury 3-bedroom villas in Ubud generated:

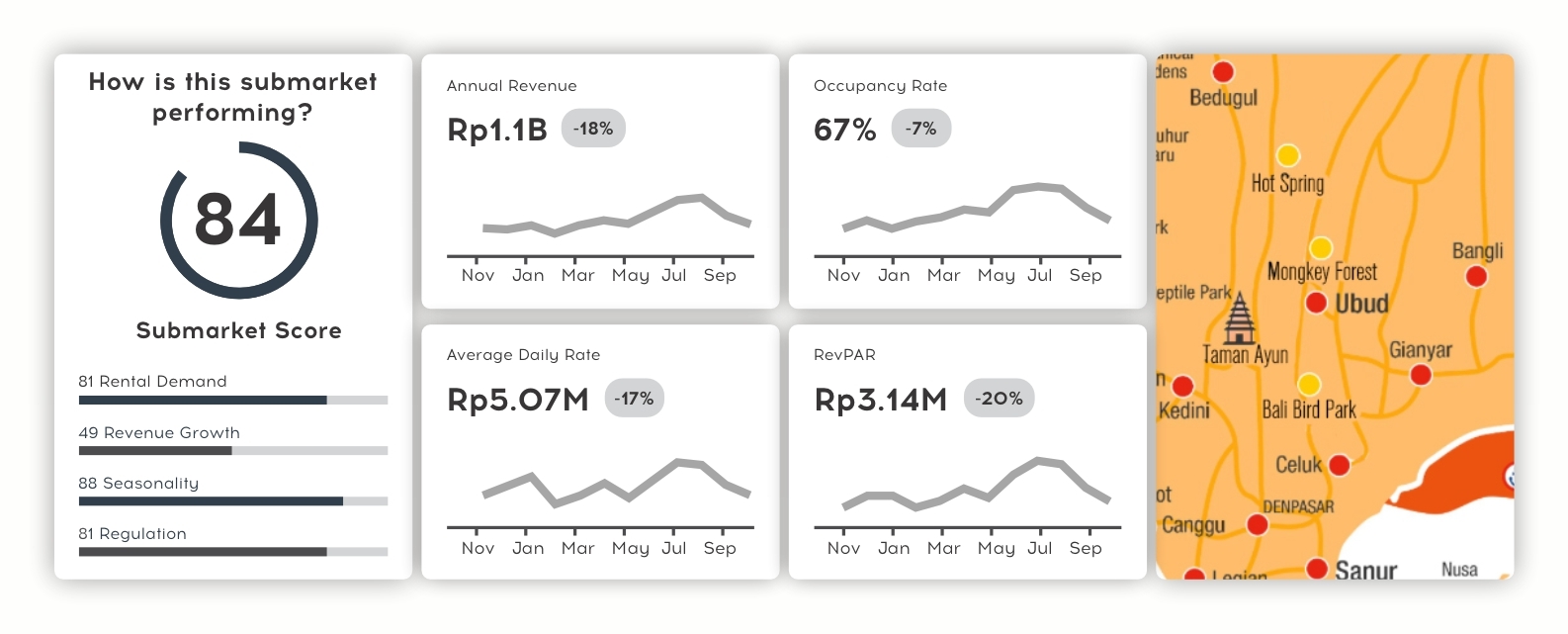

Rp 1.1B in annual revenue, showing a slight downward adjustment over the year (-18%).

This figure is still considered healthy for the Ubud premium segment, with many properties compensating for seasonality through strong long-stay occupancy and curated hospitality services.

Occupancy Rate

Average occupancy: 67% (-7% YOY)

While slightly lower compared to the previous cycle, Ubud maintains consistent demand across the year with minimal volatility compared to coastal markets.

Average Daily Rate (ADR)

Current ADR: Rp 5.07M (-17%)

The ADR decline reflects broader market normalization after the record pricing highs of 2022–2024. Despite this, luxury villas continue to retain premium positioning due to limited high-quality supply in the central and jungle-view zones.

RevPAR

Revenue per available room: Rp 3.14M (-20%)

This decrease mirrors the drops in both ADR and occupancy but still places Ubud well within the strong-performance category for Southeast Asian resort destinations.

Submarket Performance Score — 84

AIRDNA’s composite score of 84 confirms that Ubud remains one of the most resilient and stable rental submarkets in Bali.

Sub-scores:

Market Interpretation

1. Ubud remains a resilient luxury market

The combination of wellness-focused tourism and long-stay retreat culture keeps occupancy stable even during off-peak periods.

2. ADR decline indicates normalization, not a downturn

Pricing is adjusting after an unusually hot market cycle, but demand fundamentals remain strong.

3. Investment-grade performance

Even with lower KPIs, Ubud villas maintain attractive returns due to:

4. Outlook 2026–2027

Moderate ADR recovery and a return to stable 70–72% occupancy are projected as the market rebalances and tourism infrastructure expands.

Conclusion

The luxury segment in Ubud remains one of the most stable and predictable parts of Bali’s rental property market. Even with moderate KPI declines, villas demonstrate consistently strong revenue, demand, and occupancy — indicators that continue to support investment attractiveness and long-term ROI potential.

Prepared by

Denis Bukin

Mirra Centre — Real Estate Analytics

Email: bukin@mirracentre.id

Ubud continues to strengthen its position as one of Bali’s most attractive destinations for luxury short-term rentals. Despite a softer tourism cycle in 2025, demand for high-quality villas remains stable, supported by long-stay tourism, wellness retreats, and the growing influx of remote professionals.

The following analysis is based on AIRDNA data for 3-bedroom luxury villas in Ubud and reflects performance trends over the last 12 months.

Key Performance Indicators (KPI)

Annual Revenue

Luxury 3-bedroom villas in Ubud generated:

Rp 1.1B in annual revenue, showing a slight downward adjustment over the year (-18%).

This figure is still considered healthy for the Ubud premium segment, with many properties compensating for seasonality through strong long-stay occupancy and curated hospitality services.

Occupancy Rate

Average occupancy: 67% (-7% YOY)

While slightly lower compared to the previous cycle, Ubud maintains consistent demand across the year with minimal volatility compared to coastal markets.

Average Daily Rate (ADR)

Current ADR: Rp 5.07M (-17%)

The ADR decline reflects broader market normalization after the record pricing highs of 2022–2024. Despite this, luxury villas continue to retain premium positioning due to limited high-quality supply in the central and jungle-view zones.

RevPAR

Revenue per available room: Rp 3.14M (-20%)

This decrease mirrors the drops in both ADR and occupancy but still places Ubud well within the strong-performance category for Southeast Asian resort destinations.

Submarket Performance Score — 84

AIRDNA’s composite score of 84 confirms that Ubud remains one of the most resilient and stable rental submarkets in Bali.

Sub-scores:

- Rental Demand — 81

- Strong year-round demand from wellness tourism, retreats, and long-stay guests.

- Revenue Growth — 49

- Moderation after two explosive years of recovery.

- Seasonality — 88

- Ubud’s occupancy curve is notably stable across the year compared to southern Bali.

- Regulation — 81

- Consistent regulatory environment improves investment predictability.

Market Interpretation

1. Ubud remains a resilient luxury market

The combination of wellness-focused tourism and long-stay retreat culture keeps occupancy stable even during off-peak periods.

2. ADR decline indicates normalization, not a downturn

Pricing is adjusting after an unusually hot market cycle, but demand fundamentals remain strong.

3. Investment-grade performance

Even with lower KPIs, Ubud villas maintain attractive returns due to:

- strong long-stay demand,

- lower operational volatility,

- limited luxury villa supply in central zones.

4. Outlook 2026–2027

Moderate ADR recovery and a return to stable 70–72% occupancy are projected as the market rebalances and tourism infrastructure expands.

Conclusion

The luxury segment in Ubud remains one of the most stable and predictable parts of Bali’s rental property market. Even with moderate KPI declines, villas demonstrate consistently strong revenue, demand, and occupancy — indicators that continue to support investment attractiveness and long-term ROI potential.

Prepared by

Denis Bukin

Mirra Centre — Real Estate Analytics

Email: bukin@mirracentre.id